CANNABIS FINANCING WE OFFER

We Provide Cannabis Financing To...

Cannabis growers, cultivators, dispensaries, processors, medical marijuana (MMJ) practices, cannabis distributors, edible companies, fencing, security and money transfer businesses, greenhouse manufacturers and distributors, laboratories, cannabis equipment vendors, hemp farmers, hemp processors and distributors, and many others.

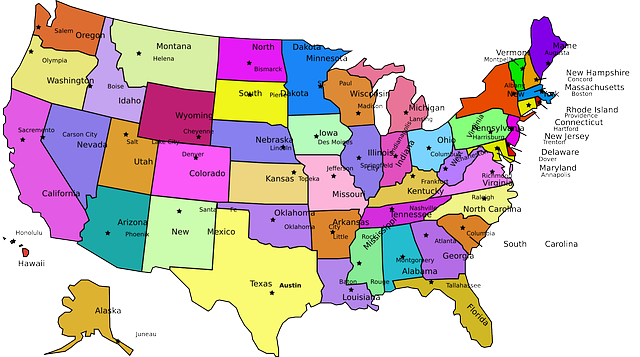

What States do we provide cannabis financing for legal recreational marijuana businesses?

As of March 2020 the following 17 states and DC are legalized for recreational marijuana use. We provide cannabis financing for marijuana businesses in all these states: Alaska | Arizona | California | Colorado | Illinois | Maine | Massachusetts | Michigan | Montana | Nevada | New Jersey | New York | Oregon | South Dakota | Vermont | Virginia | Washington | DCWhich states do we provide cannabis financing for legal medical marijuana businesses?

As of March 2020 the following 37 states an DC are legalized for medical marijuana use with a proper diagnosis. We cannabis financing and business lending for medical marijuana businesses and DC for all these states: Alabama | Alaska | Arizona | Arkansas | California | Colorado | Connecticut | Delaware | Florida | Hawaii | Illinois | Louisiana | Maine | Maryland | Massachusetts | Michigan | Minnesota | Mississippi | Missouri | Montana | Nevada | New Hampshire | New Jersey | New Mexico | New York | North Dakota | Ohio | Oklahoma | Oregon | Pennsylvania | Rhode Island | South Dakota | Utah | Vermont | Washington | Washington D.C. | West Virginia We also provide cannabis business loans for legal hemp businesses in all 50 states and DC. That's not all, we are a global company and provide marijuana, hemp and cannabis financing for legal businesses in Canada, Europe, South America, and throughout the globe.

Cannabis Financing Risk Assessment

The main objective of cannabis financing is to determine the risk involved in lending to a particular business project and answer these questions: 1) Do we want to offer a loan to this company? 2) If yes, what rate and terms can we offer that will cover our risk assessment. The lender determines this risk by analyzing the business and it's financials including these more specific risk factors for real estate loan transactions: Location of Business – if the loan involves real estate for construction, purchase, or refi, the lender needs to assess how difficult a potential resale of a property would be in the event of default. The more rural a property is the more difficult it is to resell if needed so many cannabis lenders will not consider financing cannabis real estate if it is in a rural area. They prefer properties in metro areas where there is a vibrant real estate market of ready and willing buyers. Location is also assessed from the standpoint of the city's market viability. Does the city have a growing economy with strong labor and business environment or is it declining and for how long has either been the case. The same questions apply to the cannabis industry in that location. The lender will also examine: To what extent has the local municipality embraced cannabis business and what are their licensing guidelines? Does the borrower have the appropriate state and municipal licensing required to conduct business as stated? For construction loans, does the borrower have permits required to build on the land or manufacture in a building? All of these market factors of course affect the value of a property for real estate transactions. Borrowers for loans of course want the value of their property to be as high as possible so they can have more equity in the property and also a higher loan to value (LTV). Since the market value for cannabis leases on commercial properties is typically much higher than traditional business lease value, borrowers want the lender and appraisers to see the value based on the cannabis value (also known as "green value") however most appraisers and lenders appraise the value based on traditional value. The lender asks, what would the lease value of this property be if I had to lease to a tomato processor vs. a cannabis processor with the tomato processor of course representing traditional value? Lenders take this risk approach because they recognize the newness and volatility of the cannabis real estate market and believe that the high lease value over time will likely decline and be more on par with traditional value. For cannabis equipment financing, the lender will evaluate some of the same risk factors of real estate transactions but with different nuances. They examine the location of the business more from a market viability standpoint. The asset itself (the equipment) is evaluated for it’s appraised and resale value like real estate however the location of the equipment is not as big a determinant except for shipping costs of the equipment. More important are the type of cannabis equipment and whether there is a vibrant market of buyers for that equipment should the borrower default on a lease or loan. The lender will look at the brand of the equipment and determine the average resale value of that equipment. Like automobiles, certain brands hold their value more than others and certain types of autos (trucks and SUV’s today) may maintain value more than sedans for example. Age of Business - Is the company a startup (sometimes called pre-revenue) or have they been operating for a while? Since a vast majority of businesses fail, the longer you have been in business, the greater the chances of your success. This is a sticky point in cannabis lending since the cannabis industry is still in it's infancy, most businesses are new and do not have a track record of income and success. Can you get cannabis financing as a startup? Some lenders will not lend to startups for these reasons - too much risk and no business income to support the loan. For those lenders that will lend to cannabis startups, they look to collateralize business and equipment assets while looking for other income a borrower may have to support the loan payments and lower lender risk. Industry and Business Experience - Just because you may be a startup operation does not mean you have no cannabis industry experience and that is important for a lender for the obvious - the more experience you have in the industry, the greater chances of success you will have. You are in a stronger position having already learned some of the game, made mistakes you won't make again, etc. The same goes for overall business experience. You can have industry experience but maybe no business experience meaning this is your first business operation. Business Income - Goes without saying however the greater your income, the more likely you are to make your loan payments. So lenders like to see satisfactory loan payments to support the debt. Many will use a calculation called Debt Service Coverage Ratio (DSCR) to determine whether you have enough income to support the debt based on the lender's risk tolerance. Balance Sheet - The balance sheet shows the overall financial position of the business - assets vs. liabilities. The more assets compared to liabilities or net equity you have in your business, the more comfortable the lender will be in providing your business a loan. You may be a startup with no income but you may have a substantial amount of cash and real estate holdings to help offset income. Conversely, you may have a great deal of income yet a tremendous amount of liabilities including other debt. The balance sheet offers a clearer perspective of the overall health of the business and thus many lenders like to review it. What You State vs. Actual - Here's an important tip. Under the guise of positioning their business in the best light, many borrowers will inflate their income and assets and minimize their liabilities or lack of income when conversing with a lender. What the borrower may not realize is the lender is not going to "take your word for it". All of these key risk factors need to be verified with documentation such as tax returns, property deeds, mortgage statements, etc. When a borrower is not providing a truthful picture of their actual position and the lender determines through the verification process their is a disparity, the lender is not happy because you have wasted their time, and it is often a deal breaker.7 Step Process for Cannabis Financing

The financing process for cannabis is similar to most traditional commercial lending practices. The steps are more or less in this order: Step 1: Do an initial assessment of your loan request seeking to know the dollar amount of the loan request, the use of funds, the age of the business, business income, management team experience, location and type of cannabis business, and so forth to get a basic understanding of the loan request. This gives the lender an idea up front whether there is enough of a fit to move forward based on their lending guidelines. Step 2: Collect supporting documents including pertinent financials and business plan summaries, real estate appraisals or vendor quotes as applicable, etc. Step 3: Evaluation of supporting documents to determine risk and viability (underwriting). Step 4: Decline or Approval – after evaluation of the loan request, the lender will either decline the loan request or make an offer (preliminary approval). The offer may come in the form of a term sheet, letter of intent (LOI), or memorandum of understanding (MOU). These offers typically include the loan amount offered, the interest rate, the term of the loan, amortization period, closing costs required, etc. The offer may come with conditions that need to be met for final approval such as completion of a real estate appraisal or completed site inspection for example. Step 5: Once conditions of the offer are met, a final approval is offered and a formal loan agreement is structured. The borrower will review the loan agreement to see if the content and terms are agreeable. The lender may or may not have flexibility in the amount of redlining in the agreement they will allow by the borrower or the borrower’s attorney. Step 6: If the loan agreement is satisfactory for both parties, it is signed by the parties and plans for closing are made. Step 7: Closing – at closing, all closing documents are signed and the loan proceeds are disbursed in a full lump sum or as a first tranche into the borrower’s bank account less any lender fees. A celebration is likely for all parties involved as everyone wins!

Please Share to Help Others Too...

Marijuana Disclosure

NewVista Financing services and products are strictly limited to the confines of relevant state laws and regulations relating to state-legal medical marijuana and adult use marijuana. All activities related to marijuana are currently illegal under the laws of the United States of America and nothing contained herein nor are any of our services provided intended to assist in any way with violation of any applicable law.

NewVista Financing is not, and will not, be engaged in the possession, cultivation, distribution, or otherwise related end-to-end activity associated with cannabis.